20th Shanghai International Fisheries and Seafood Exhibition

18th Shanghai International Aquaculture Exhibition

展会倒计时天

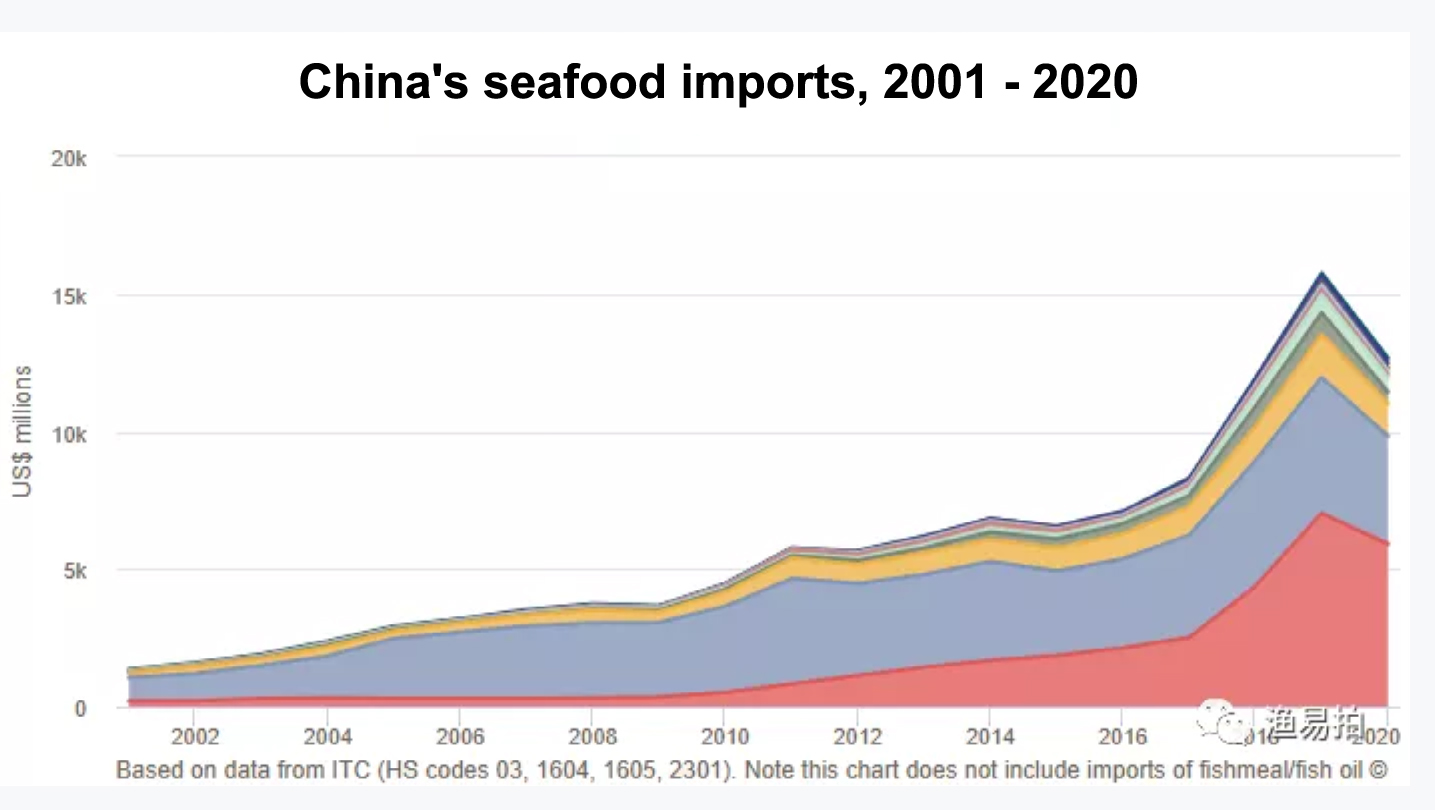

Due to the impact of COVID, China’s seafood imports in 2020 have shrunk by nearly 20% from US$15.6 billion in the same period in 2019 to US$12.7 billion. Ended two consecutive years of double-digit growth.

Cui He, the head of the China Aquatic Products Processing and Marketing Alliance (CAPPMA), said: “In 2020, China’s aquatic product imports will definitely decline. China’s seafood imports may remain sluggish until 2021, and of course they will not reach the “Ling The impressive level of 2019." "The key is to look at the epidemic prevention situation, the progress of vaccination in the second half of the year, and the economic recovery worldwide. The recovery of seafood consumption will involve many factors. "

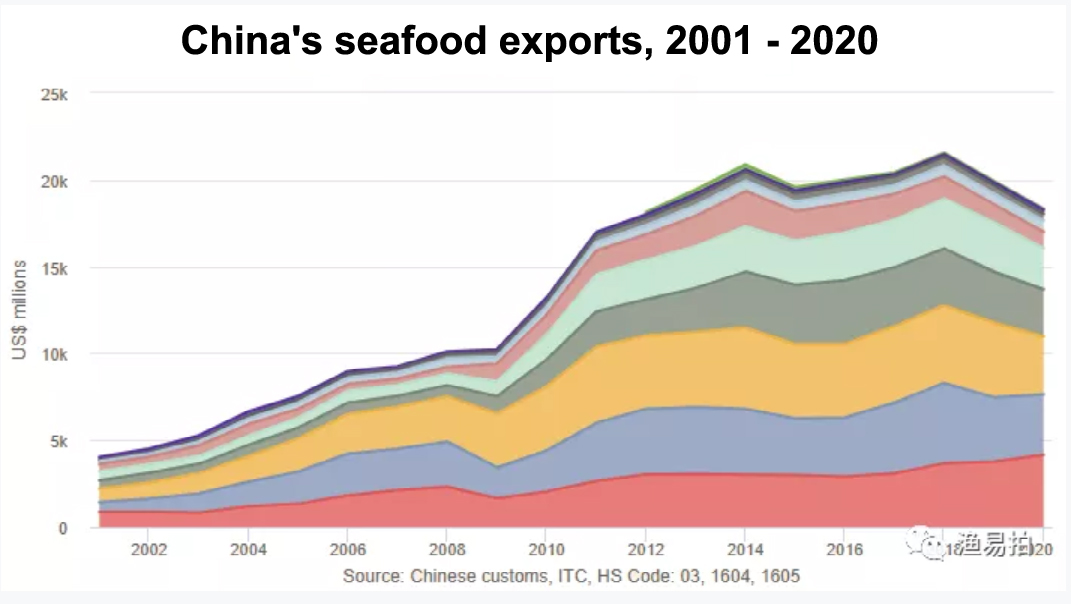

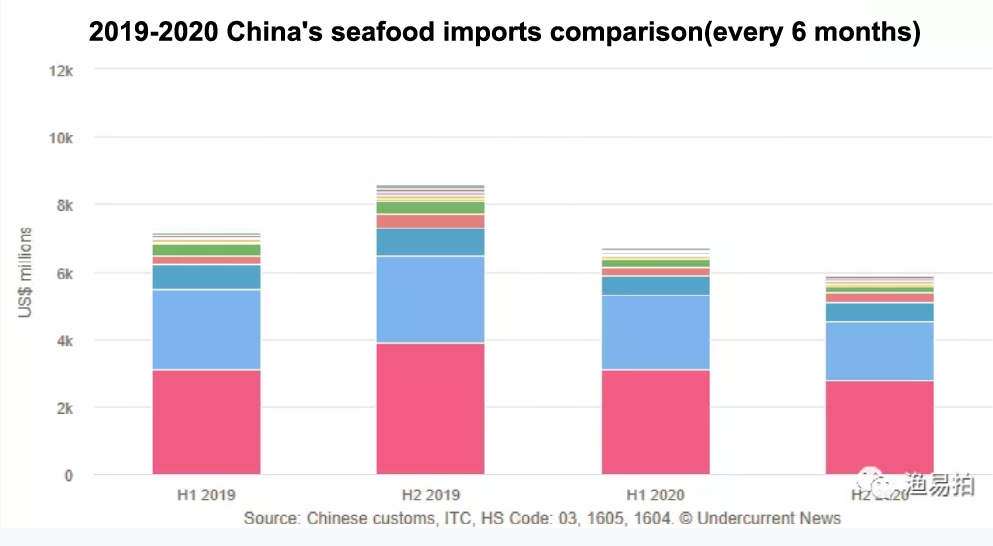

China’s seafood exports also shrank by 8% to $18.3 billion, a 15% drop from the peak of $21.5 billion in 2018. China is the world's largest seafood exporter. But "this year's COVID epidemic has affected the development of the entire global economy." According to CAPPMA, the import volume is 5.5 million tons, which is similar to 2018, but "significantly lower" than the 6.2 million tons in 2019. Especially after the positive traces of coronavirus were detected on the packages of imported seafood in July, there was a "severe contraction" in demand in the second half of 2020 (H2), and annual imports fell. In the second half of 2020, China’s seafood imports shrank by 31% to 5.95 billion US dollars, while in the first half of the year, they fell 6% year-on-year to 6.72 billion US dollars.

Since the new crown of imported seafood packaging was tested positive in July, it has repeatedly tested positive on imported cold chain outer packaging. Cui said: “Everyone has become more cautious about imported seafood.” This has also affected the processing and processing of imported seafood. Re-exported Chinese processors. "The speed of customs clearance has also slowed down, and products must undergo strict inspections when they enter the port, which means that they stay in the port for longer. Therefore, the cost of logistics increases.

Cui said that seafood sales in China's fast-growing catering service channel have also been affected by the epidemic. The catering service trade "has not yet fully recovered." In 2020, imports of Atlantic salmon, mainly whole fresh fish consumed by Japanese-style sushi restaurants, fell 47% year-on-year to US$418 million. After consumers’concerns, Chinese supermarkets had to remove imported seafood products from their shelves, test them, and then return the products for sale again.

However, the positive side is that due to more home cooking, retail and online sales of imported seafood remain stable, and shrimp and pangasius have less impact. "In 2020, China imported 544,000 tons of frozen warm-water shrimp, a year-on-year decrease of 16%, although the second half of 2020 (H2) decreased by 48% year-on-year.

News source: Yuyipai